Applied Intelligence Portfolios

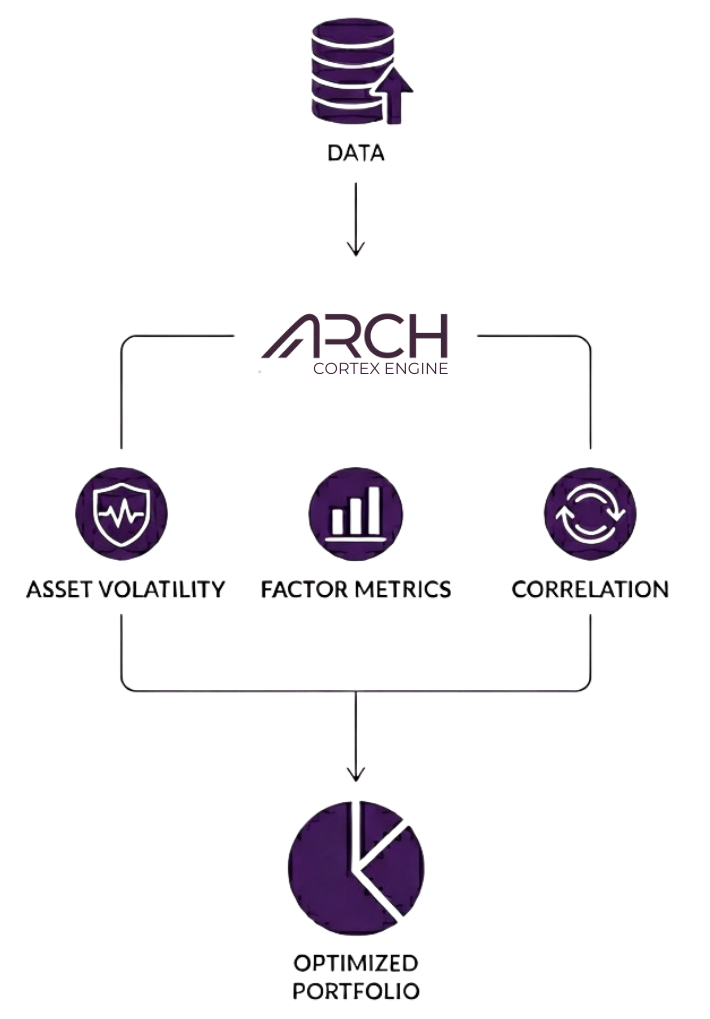

Arch Analytics' proprietary Arch Cortex Engine (ACE) dynamically optimizes portfolios to navigate changing market conditions and deliver superior risk-adjusted returns.

Intelligently Adapt to Changing Market Conditions

The Problem: Static Outdated Models

Static, 60/40-style allocations fail to adapt to a world of rapidly changing correlations and risk regimes, leaving investors sub-optimally allocated with inferior risk-adjusted returns.

The Solution: Arch Cortex Engine (ACE)

Our framework and proprietary ACE optimization engine combines vast datasets and layering approach to build portfolios that adapt to deliver superior risk-adjusted returns.

The Result: Resilient Portfolios

We build portfolios optimized around specific goals and factors to minimize volatility and maximize risk-adjusted returns.

Building Intelligent Portfolios

To build intelligent portfolios utilizing machine learning optimization to improve investor outcomes.

Get in TouchAbout Arch Analytics

Arch Analytics was founded on a simple but powerful observation based on 40+ years on the trading and solutions desks of major investment banks: the traditional methods of portfolio construction are outdated and not meeting investor needs.

Our solution is our Arch Cortex Engine (ACE), a proprietary machine learning optimization. ACE builds intelligent optimized portfolios for specific goals and factors to minimize volatility and maximize returns.

Disclaimer

Copyright © 2025 by Arch Indices Corporation. All rights reserved. Arch Analytics and Arch Indices are a trademark of Arch Indices Corporation.

The content contained herein does not constitute an offer of investment services. All information provided is impersonal and not tailored to the needs of any person, entity or group of persons unless specifically licensed to do so. Information, indices, portfolios, and analytics provided by Arch Indices is solely for informational purposes.

An index or model portfolio is a hypothetical basket and cannot be invested in directly. Please consult your investment advisor for investment products that track indices or model portfolios.