An Intelligent Foundation for Portfolio Construction

Founded on a powerful observation from 40 years inside major investment banks: the traditional rules of portfolio construction are broken.

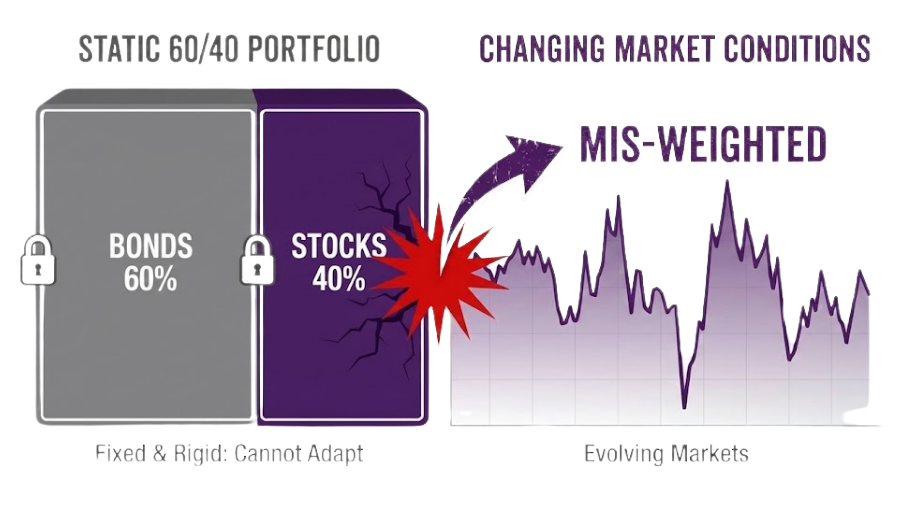

The Problem: Static Allocations Do Not Adapt to Changing Markets

Static, 60/40-style allocations and arbitrary weighting schemes fail to adapt to a world of rapidly changing correlations and risk regimes, leaving investors exposed.

Traditional models rely on flawed assumptions and fail to see the full risk picture, leading to sub-optimal weights that erode long-term returns.

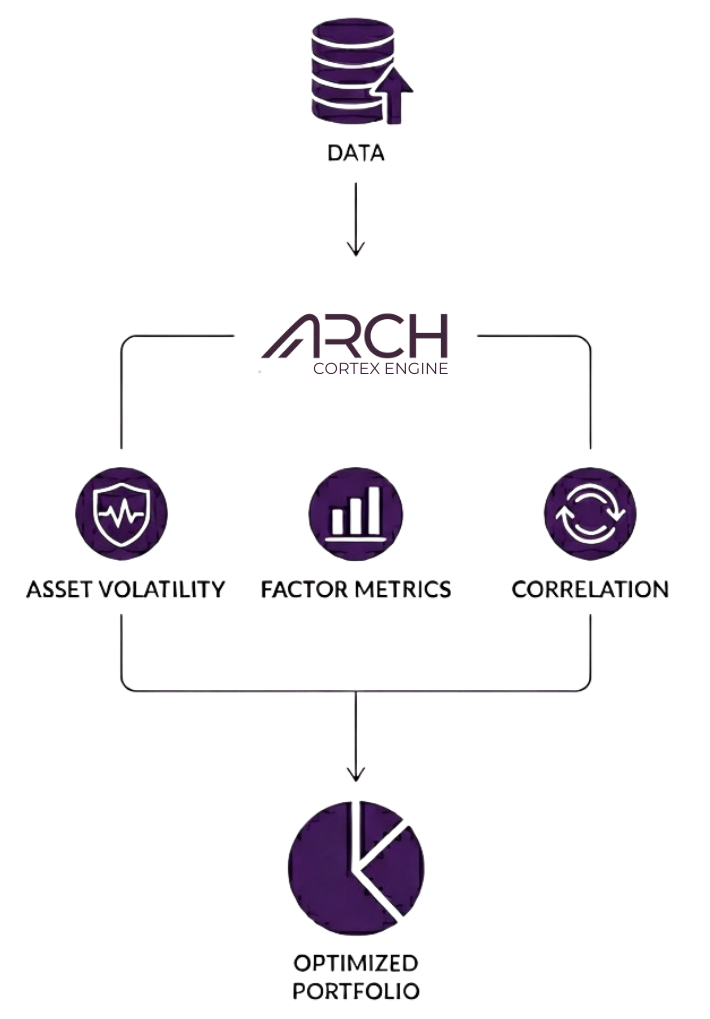

The Solution: Arch Cortex Engine (ACE)

At the heart of our firm is the Arch Cortex Engine (ACE), our proprietary analytical engine that builds and adapts portfolios for changing market conditions.

ACE constructs optimized portfolios engineered around goals and factors to maximize risk-adjusted returns while actively minimizing uncompensated risk.

The intelligence behind ACE is a proprietary machine learning framework and optimization engine.

Our Founders: Decades of Quantitative Expertise

Yang Tang

Co-Founder & CEO

Yang is the CEO and a co-founder of Arch Analytics and Arch Indices.

Yang spent over a decade in macro solutions, structuring and sales roles at Morgan Stanley, Citi, Deutsche Bank, and Credit Agricole CIB. Yang has worked with banks, insurers, and asset managers globally on solutions across asset classes for asset liability, yield enhancement, capital, and tactical opportunities. These structured solutions combined advanced machine learning and derivative replication with practitioner knowledge of financial markets to achieve client outcomes.

Yang has earned a MBA from Columbia Business School and a BS in Economics from Purdue University. Prior to Columbia, Yang worked in research and commodities sales.

Dr. Jinghua "Jacob" Kuang

Co-Founder & CPO

Jacob is the CPO and a co-founder of Arch Analytics and Arch Indices.

Jacob spent over two decades at Citi and its predecessor Salomon Brothers in trading, structuring, and quantitative research/analytics. Jacob has deep expertise working with institutional and private bank clients in multi-asset derivative solutions, cash products, and structured notes. Jacob has extensive machine learning, neural network, financial engineering, and analytics knowledge from roles in research, modeling, and quantitative analysis in both cash products and derivatives.

Jacob has earned a PhD in Mathematics from the University of Minnesota and was an Assistant Professor of Mathematics at Penn State University.

Disclaimer

Copyright © 2025 by Arch Indices Corporation. All rights reserved. Arch Analytics and Arch Indices are a trademark of Arch Indices Corporation.

The content contained herein does not constitute an offer of investment services. All information provided is impersonal and not tailored to the needs of any person, entity or group of persons unless specifically licensed to do so. Information, indices, portfolios, and analytics provided by Arch Indices is solely for informational purposes.

An index or model portfolio is a hypothetical basket and cannot be invested in directly. Please consult your investment advisor for investment products that track indices or model portfolios.