The Future of Portfolio Management

The Arch Cortex Engine (ACE)

Arch Analytics leverages our proprietary Arch Cortex Engine (ACE) to build intelligent, adaptive portfolios that navigate changing market conditions to deliver superior risk-adjusted returns.

Our Engine

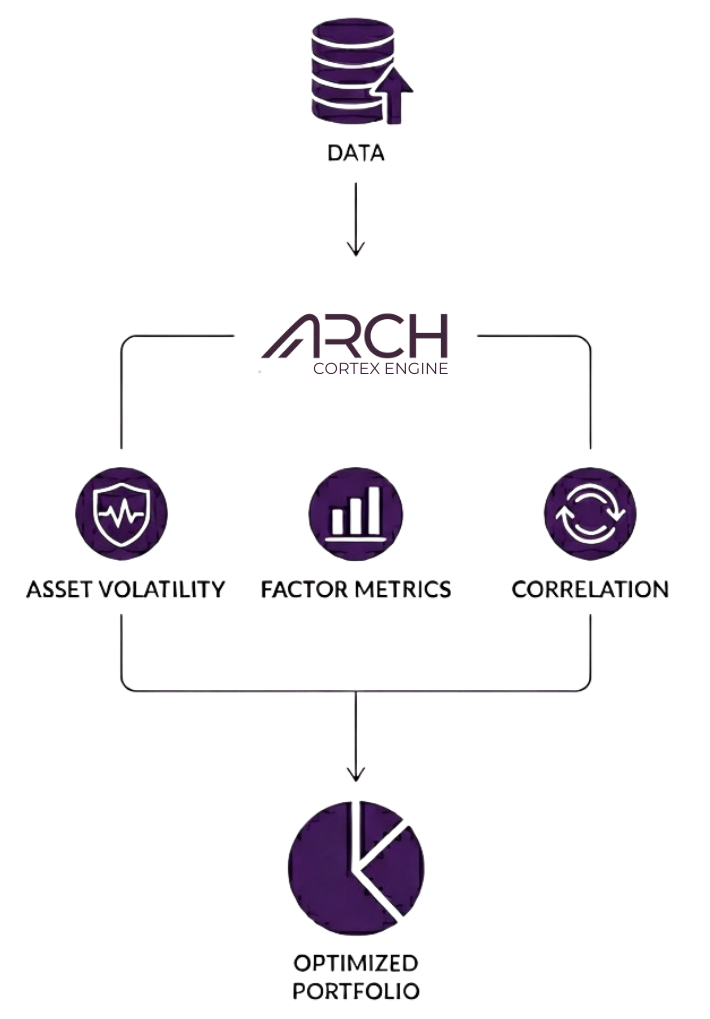

From Data to Decisions

ACE transforms market data into optimized portfolios through a dynamic machine learning process.

Machine Learning Factor Engine

ACE continuously ingests vast amounts of market data, using advanced machine learning models to identify and build forward looking and market observed factors that drive returns.

Factor Analysis & Selection

Our proprietary analysis layer examines the machine-learning-derived and market observed factors, assessing their quality, relevance, and potential impact for implementation into our proprietary optimization engine.

Arch Proprietary Optimization

Our proprietary optimization engine constructs portfolios using an adaptive recursive process to maximize factor exposure while balancing risk, asset correlation, and other constraints.

The Arch Advantage

Delivering Superior, Risk-Adjusted Returns

By combining machine intelligence with proprietary optimization, ACE delivers tangible benefits for investors.

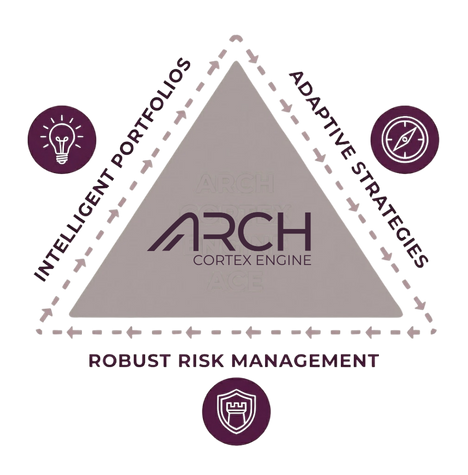

Intelligent Portfolios

Portfolios are not static; they are built from dynamic factors that reflect current market realities.

Adaptive Strategies

ACE-powered portfolios are designed to adapt to changing market conditions, actively managing risk.

Robust Risk Management

Our proprietary optimization seeks to deliver superior risk-adjusted returns while using asset correlations in a total portfolio approach.

Put the Arch Cortex Engine to work

Discover how our intelligent, adaptive portfolios can help you achieve your financial goals.

Disclaimer

Copyright © 2025 by Arch Indices Corporation. All rights reserved. Arch Analytics and Arch Indices are a trademark of Arch Indices Corporation.

The content contained herein does not constitute an offer of investment services. All information provided is impersonal and not tailored to the needs of any person, entity or group of persons unless specifically licensed to do so. Information, indices, portfolios, and analytics provided by Arch Indices is solely for informational purposes.

An index or model portfolio is a hypothetical basket and cannot be invested in directly. Please consult your investment advisor for investment products that track indices or model portfolios.